· Jay Smith · Articles · 7 min read

Preparing Your Business for Cyber Insurance - The God Particle IT Approach

This article explores steps in preparing for cyber insurance including risk assessment, evaluating security measures, implementing robust IT policies and employee training, and partnering with an experienced provider.

Understanding Cyber Insurance

Cyber insurance is a type of insurance that provides coverage for businesses in the event of a cyber attack or data breach. It helps protect businesses from the financial and reputational damages that can result from these incidents. Cyber insurance policies typically cover expenses such as legal fees, notification costs, credit monitoring services, and public relations efforts. It is important for businesses to understand the scope of coverage and the specific terms and conditions of their cyber insurance policy to ensure they are adequately protected.

Benefits of Cyber Insurance

Cyber insurance provides several benefits for businesses. It not only helps cover financial losses resulting from cyber attacks but also provides support in the form of incident response, legal assistance, and reputation management. Additionally, cyber insurance policies often include coverage for regulatory fines and penalties, as well as notification and credit monitoring services for affected customers. By investing in cyber insurance, businesses can mitigate the financial and reputational risks associated with cyber incidents and ensure a faster recovery process.

Key Considerations for Cyber Insurance

When considering cyber insurance for your business, there are several key considerations that you should keep in mind. First and foremost, it is important to carefully review the coverage options and policy terms offered by different insurance providers. You should assess whether the policy aligns with your business’s specific needs and potential cyber risks. Additionally, it is crucial to understand the exclusions and limitations of the policy, as well as any deductibles or waiting periods that may apply. Furthermore, it is advisable to evaluate the financial strength and reputation of the insurance provider to ensure they can effectively handle claims and provide support in the event of a cyber incident. Lastly, consider seeking expert advice from a cybersecurity professional or an experienced insurance broker to help you navigate the complexities of cyber insurance and make an informed decision.

Assessing Your Business’s Cyber Risks

Identifying Vulnerabilities

One of the first steps in preparing your business for cyber insurance is identifying vulnerabilities. This involves conducting a thorough assessment of your IT infrastructure, systems, and processes to determine any weaknesses that could be exploited by cybercriminals. It is important to consider both internal and external vulnerabilities, such as outdated software, weak passwords, and unsecured network connections. Additionally, you should assess the potential impact of these vulnerabilities on your business, including the potential financial and reputational damage. By identifying vulnerabilities early on, you can take proactive steps to mitigate risks and strengthen your cybersecurity defenses.

Assessing Potential Impact

When assessing potential impact, it is important to consider the various ways a cyber attack can affect your business. This includes financial losses, reputational damage, legal liabilities, and customer trust. One effective way to evaluate the potential impact is to create a table that lists the different types of impact and their corresponding severity levels. This will help you prioritize your cybersecurity efforts and allocate resources accordingly. Additionally, it is crucial to regularly update this table as new threats emerge and your business evolves.

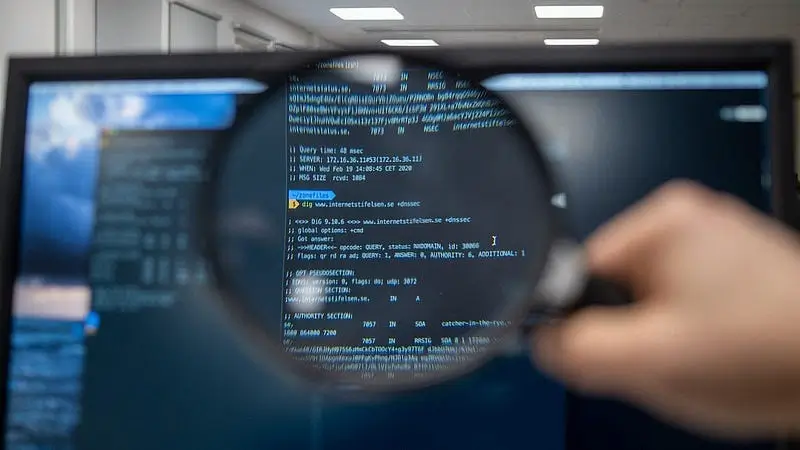

Evaluating Existing Security Measures

Once you have identified the vulnerabilities and assessed the potential impact, it is crucial to evaluate your existing security measures. This evaluation will help you determine the effectiveness of your current security controls and identify any gaps that need to be addressed. Consider using a security assessment framework to systematically evaluate your security controls and measure their effectiveness. Additionally, conduct regular penetration testing to simulate real-world cyber attacks and identify any vulnerabilities that may have been overlooked. By regularly evaluating and updating your security measures, you can ensure that your business is well-prepared for cyber threats and minimize the risk of a successful cyber attack.

Implementing Cybersecurity Measures

Creating a Robust Security Policy

A robust security policy is the foundation of a strong cybersecurity posture. It outlines the rules and guidelines that employees must follow to protect sensitive information and prevent cyber threats. A comprehensive security policy should include password requirements, data encryption protocols, and access controls. Additionally, it should address incident response procedures and employee training. By implementing a robust security policy, businesses can minimize the risk of cyberattacks and ensure the safety of their digital assets.

Training Employees on Cybersecurity

Training employees on cybersecurity is crucial to ensure that they are equipped with the knowledge and skills to protect your business from cyber threats. This training should cover topics such as identifying phishing emails, creating strong passwords, and recognizing suspicious activities. Additionally, employees should be educated on the importance of regularly updating software and reporting any security incidents. By investing in comprehensive cybersecurity training, you can significantly reduce the risk of a cyber attack and strengthen your overall security posture.

Implementing Multi-factor Authentication

Implementing multi-factor authentication is a crucial step in enhancing the security of your business’s digital assets. By requiring users to provide multiple forms of verification, such as a password and a unique code sent to their mobile device, you can significantly reduce the risk of unauthorized access. This added layer of security can help protect sensitive information and prevent potential cyber attacks. Additionally, consider using biometric authentication methods, such as fingerprint or facial recognition, for an even more secure authentication process. By implementing multi-factor authentication, you can strengthen your business’s defense against cyber threats and demonstrate your commitment to safeguarding your data.

Conclusion

Importance of Cyber Insurance

Cyber insurance is an essential component of a comprehensive risk management strategy for businesses. It provides financial protection against the potential damages and losses resulting from cyber attacks and data breaches. With the increasing frequency and sophistication of cyber threats, having cyber insurance can help businesses mitigate the financial impact of such incidents. In the event of a cyber attack, the costs associated with investigating and remediating the breach, notifying affected individuals, and potential legal liabilities can be significant. Cyber insurance can cover these costs and provide support to businesses during the recovery process. It is important for businesses to partner with an experienced insurance provider, such as God Particle IT, who understands the unique risks and challenges of the digital landscape.

Taking Action to Protect Your Business

To effectively protect your business from cyber risks, it is crucial to take proactive measures. Start by conducting a thorough risk assessment to identify vulnerabilities and potential impact. This will help you prioritize your cybersecurity efforts. Next, evaluate your existing security measures and determine if they are sufficient or if additional measures are needed. Consider implementing a robust security policy that outlines best practices for employees to follow. Regularly train your employees on cybersecurity awareness and provide them with the necessary tools and resources to protect against cyber threats. Implementing multi-factor authentication can add an extra layer of security to your systems and applications. By taking these actions, you can significantly reduce the likelihood of a cyber incident and demonstrate to cyber insurance providers that you are committed to protecting your business.

Partnering with an Experienced Insurance Provider

When it comes to cyber insurance, it is crucial to partner with an experienced insurance provider. They have the expertise and knowledge to guide you through the process of selecting the right coverage for your business. An experienced provider will also have a deep understanding of the cyber risks that businesses face today and can tailor the insurance policy to meet your specific needs. Additionally, they can provide valuable insights and recommendations on cybersecurity measures that you can implement to mitigate risks and reduce the likelihood of a cyberattack. By partnering with an experienced insurance provider, you can ensure that your business is well-protected and prepared for any potential cyber threats.